Are you struggling to find trading opportunities when you use fundamental analysis? News reports and eco releases can be strong influencers of market price, but sometimes they don’t give a clear enough indication of what to trade, and more investigation is called for. Time to check the forex charts!

Some traders use indicators to make sense of price history, while others prefer to “eyeball” the situation and make their own conclusions. Either way, it comes down to technical analysis and recognizing patterns in the price history, which brings us to the topic of this article. Which forex chart type reveals more? Should you use lines, bars, or candles? Here’s a simple breakdown of those options so you can start using the one that best suits your trading style.

Line charts

Right-click on an open forex chart and you’ll see three viewing options: lines, bars, and candlesticks. Lines display a currency pair’s price history in a much cleaner way. Lines track a simple straight line between the opening price and the closing price. Anything that happens between those two points will not be visible on a line chart. Since line charts don’t show the daily highs and lows, it makes them better suited to long-term analysis offering a wider simplistic overview. If you are planning to keep an order open for more than a week, then lines give a much cleaner picture from which to base forecasts. For short-term orders that present a risk of volatility, a bar chart is much more informative.

Bar charts

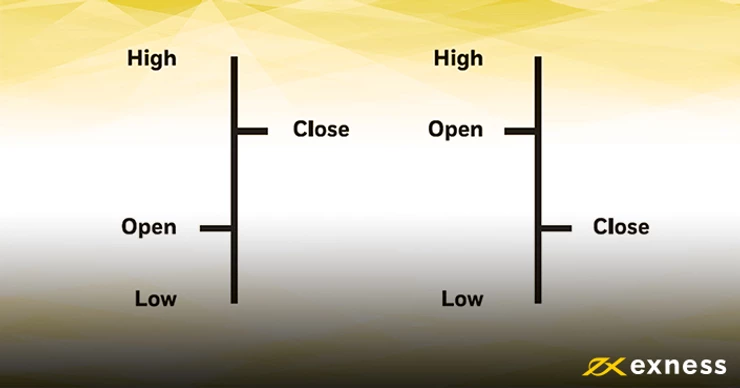

Like lines, bars also show the opening and closing prices, but bars display price highs and lows. The lowest and highest levels on each bar represent the lows and highs for the selected period. To the left of the bar is the opening price, to the right is the closing price

Most traders find bars harder to read than price lines, but there are certain advantages to using bars when performing technical analysis. When setting ‘Stop Loss’ (SL) and ‘Take Profit’ (TP), it can be useful to indicate just how extreme the lows and highs are compared to the closing prices. If the bars are long, but the opening and closing prices are crammed closer to the middle, it can mean that the selected period is experiencing price volatility. Extreme highs and lows tend to prematurely trigger a tight ‘SL’ or ‘TP’ order. If you’re opening a trade for the day, check the previous candlesticks to see if the wicks were far from the open and close? Set your ‘SL’ or ‘TP’ accordingly.

Candlestick charts

Candlesticks are probably the most popular way to view forex charts. This type of chart shows the same trading information as bars, but many traders prefer the style and insist that they are easier to read.

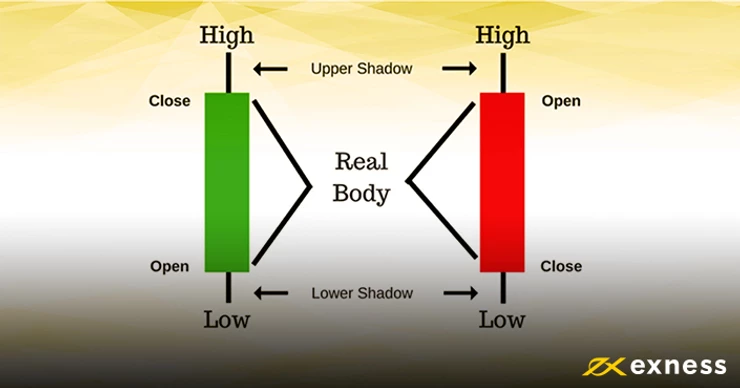

CSimilar to bars, the candlestick body shows the opening and closing prices, and the wicks that are sticking out of the top and/ or bottom represent the highs and lows of the selected period. The direction of the price for the period is shown by the color used. The most popular contrasts being green for a rise and red for a fall, but this is a completely customizable feature.

Just remember that the highs and lows never change, but the opening price on a candlestick switches place whenever the price direction changes. A rising trend opens on the bottom. A declining trend opens on the top. Candlesticks take a little getting used to, but when you do, there are dozens of patterns to watch out for that have a history of indicating rally moves or crashes.

So which forex chart is better for forecasting?

Take a look at the three forex chart screenshots in this article. Which one seems the easiest to read or analyze? It’s really down to your own personal preference. Lines are great for a quick and easy overview, but they show much less when you’re looking at a one-minute timeframe. Consider using lines for long-term trading analysis or quick checks on how a fundamental release is affecting market prices. If you tend to open and close orders in the same day, candlesticks might be a better choice.

Test your analytical eye on the foreign exchange market

Tags:

AUD, Brexit, Brexit, Banks, CAD, CHF, CNH. currency hedging, CZK, Donald Trump, EU EUR, forex trading, GBP, Global, Growth, Fears, Gold Prices, Government Shutdown, HKD, Is forex trading profitable, JPY Leverage, Mean Reversion, MXN, NOK, NZD, Passive income, popular strategies, Risk Management, RUB, Safe, haven currencies, second referendum, SEK SGD, Silver, Price, technical indicators, trading account, Trading Basics, trading psychology, Trailing Stop, trump wall, TRY USD, USD Price, Chart, XAG, XAU, ZAR, indicator, Forex Millennium, Karl , golden rebate, rebate, cashback,

Leave A Comment