What is a Currency Pair ?

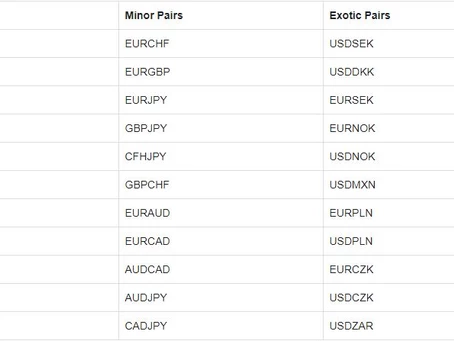

Currency is always measured against another currency and they are referred to as currency pairs. Currency pairs are generally segregated into groups. These groups are known as Majors, Minors and Exotics. Major currency pairs are generally the most popular traded currency pairs. Almost all currencies are free floated, meaning that they don’t have a set representation of value to another currency and can rise and fall in value independently. Some of currency pairs offered by HotForex available for trading are:

What is a Pip ?

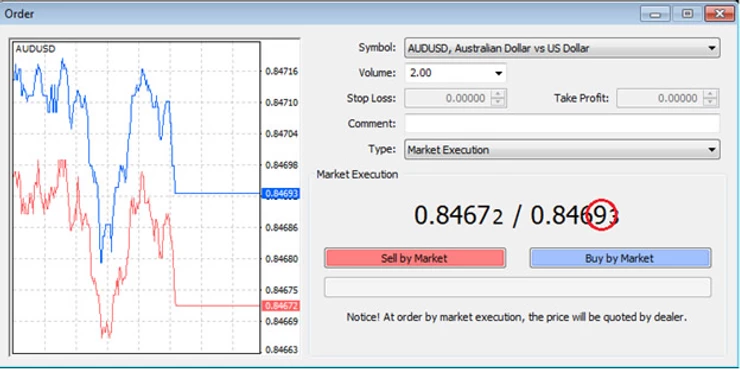

A pip is a small measurement of change in the underlying currency. Generally, it is the forth (0.0001) decimal place of a currency price, except with the Japanese Yen, where they have no denomination for cents in their currency (in the Japanese Yen, the pip is the second decimal place). Shown below is an image representing an order window reflecting the price of the AUD/USD Currency Pair

The fourth decimal place is circled red to show which decimal the pip is in reference to. If the price 0.84693 moves to 0.84683 then there was a 1 pip movement. Please note that the fifth decimal represents 1/10th of a pip.

A pip is a good reference measure to how much a trader can make based on the volume of their trades. For example, if a trader purchases a full contract the value of potential return and risk is $10 profit or loss (of the second named currency in a pair) per pip movement. You can follow the table below as a reference to potential risk or return:

Quite often, the annotation used to measure how well a trader is doing is to mention how many pips they have gained in a set time period.

What is Bid & Ask and Spread ?

With currency quotes, they are always represented with a Bid offer and an Ask offer. This denotes the price difference between buying and selling.

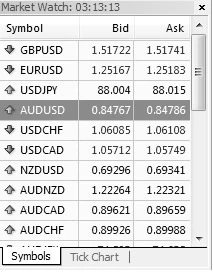

If you BUY, you are buying at the ASK price. if you SELL, you are selling at the BID price. Shown below is a list of currency pairs all showing a Bid and Ask offers.

Remember, if you opened a BUY position and you wish to close it, you are essentially selling it back, therefore the price you will be closing the position at is the BID price and vice versa.

The spread is the pip difference between the BID and ASK. If you were to look at the above image and referred to the AUD/USD then you will notice the BID as 0.84767 and the ASK as 0.84786.

This is a spread of 1.9 pips. 0.84786 – 0.84767 = 0.00019 0.00019 = 1.9 pips

What is Leverage and How much do I need to trade ?

Leverage is the amount that you are borrowing based on the deposit in your account. Default leverage is set at 100:1, meaning that for every $1 you have in your account, you have a buying power of $100. If you have $1,000 in your account, you have buying power of $100,000. Something to remember is a full contract is $100,000 of the base currency. So if you were looking to trade a Full Lot of the EUR/USD, then you would need the equivalent of EUR$100,000 in your account to trade this. If you wanted to trade a full contact and you had a leverage of 500:1, then you could take this position with only $200 in your account ($200 x 500 = $100,000). High leverage can help you take larger positions based on smaller capital in your account, but it is not without its pit falls. Larger positions result in larger dollar movements per pip and as such can wipe out smaller capital amounts in a short period of time.

Open Exness Demo Account

Open FXTm Demo Account