Foreign Exchange Definition

Foreign exchange (Forex) is the cross-country exchange of currencies and is, single handedly, the largest and most liquid financial market in the world. With an estimated $1.5 trillion in currencies traded in a single day, it eclipses the trading of other types of commodities. Unlike other commodity trading, Forex has no centralized exchange and is traded primarily through banks, brokers, dealers, financial institutions and private individuals. Due to this ability for financial institutions to trade Forex, the Forex market is open 24 hours, 5 days a week (closes Saturday morning).

Prior to the late 1990’s, Forex trading was only the practice for institutional traders and even though retail traders had access to trade the Forex market, only recently has it become popular and more common for individuals to trade Forex for profit. Most of the world’s different country currencies are free floating; meaning they retain an individual value and will appreciate and depreciate against other currencies. Currencies are always listed in pairs as they need another currency to benchmark against.

Reasons for Trading Forex

Trading Forex has many purposes and you’ll be surprised of the many levels traded that impact you and you’re not even be aware of it. For every purchase you make, the contents, ingredients, by-products, parts or materials may not necessarily be from a domestic source. It could have been bought internationally and as such the exchange of foreign currency would have had to be taken place.

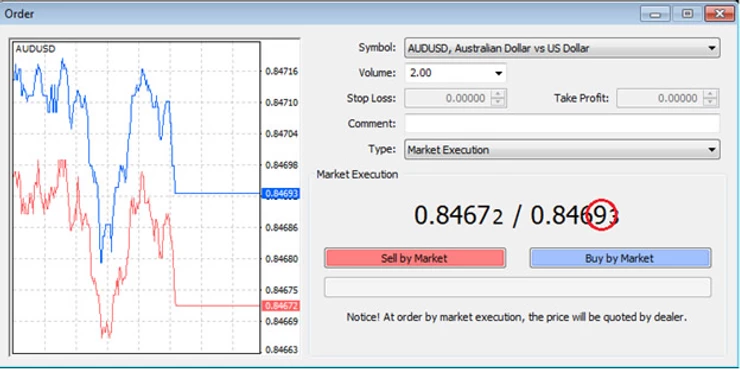

From a financial perspective, some people may trade the Forex market for profit. By taking a cross currency pair, they may exchange currency to a foreign designation hoping for domestic currency values to depreciate, thus when you convert it back you will receive more than you initially started.

For international importer or exporter of goods and services, there are great opportunities by having access to the international market. However, with fluctuating international currency rates, payment can sometimes be difficult. Initially companies make a sale for an agreed price, then on the day of payment the agreed value is significantly less than agreed to, due to a currency fluctuation is known as foreign exchange risk.

You will find all types of businesses, from large financial institutions to small retail freight forwarders will practice foreign exchange hedging. Simply put, these companies will put in place measure to ensure that their agreed payment value will represent the same value at the day of payment regardless of currency value fluctuations.

The Eight (8) Major Currencies

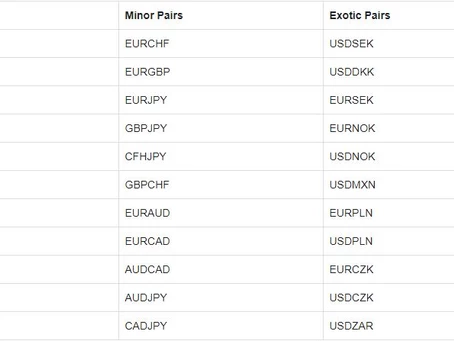

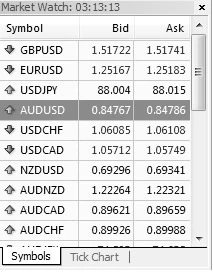

Internationally, there are eight (8) currencies that are traded more than other currencies. These are often referred to as Majors. These currencies are as follows:

USD – Unites States Dollar

JPY – Japanese Yen

GBP – British Pound

CAD – Canadian Dollar

EUR – European Currency Unit

CHF – Switzerland Dollar

AUD – Australian Dollar

NZD – New Zealand Dollar.

Certain parts of the world have part of their Saturday to trade, as it’s still Friday in other markets.

Financial institution in these countries may be dealing with the Forex market during their work hours, the Forex market is open and trading 24 hours, 5 days a week. For someone living in the East Coast of Australia, the market hours for the corresponding markets are outlined below:

New York session opens at 10:00pm and ends around 7:00am

Sydney session starts at 7:00am and ends around 4:00pm

Tokyo session begins at 9:00pm and ends around 6:00am

London opens at 5:00pm and ends around 2:00am.

Open FXTm Demo Account