Have you ever run into the word “liquidity” while reading a financial report? It’s a term that gets thrown around by forex analysts all the time. Understanding liquidity can help you choose the right order types, which leverageto use, and how long you should keep your orders open. Soon you’ll understand the relationship between liquidity and volatility. Take your trading skills to the next level with this introduction to liquidity.

So what is forex liquidity and why should you care?

Liquidity is a measure of how easily a forex currency pair can be traded. Investments that can quickly be converted into cash are said to have high liquidity. The forex CFD market is liquid by nature, and traders can open and close trades in just a few clicks.

In contrast, real estate investment is much less liquid—especially during times of economic uncertainty. People selling a property may have a long wait until they can convert their investment back into cash, which is probably why forex has become so popular as an investment vehicle. Since liquidity indicates a safer or less volatile investment option, you might want to build your trading skills by limiting your trades to high liquidity currency pairs.

How can you find high liquidity currency pairs?

So you’re looking for a currency pair that offers the benefits of liquidity. Trading volume is a good indicator of liquidity. Trading volume refers to the amount and size of the orders being placed on a given currency pair. The more volume, the more stable the price line. The eight currency pairs with the highest volume and therefore liquidity are: EURUSD (Euro vs US dollar)

USDJPY (US dollar vs Japanese yen)

GBPUSD (British pound sterling vs US dollar)

AUDUSD (Australian dollar vs US dollar)

USDCAD (US dollar vs Canadian dollar)

USDCNH (US dollar vs Chinese renminbi)

USDCHF (US dollar vs Swiss franc)

EURGBP (Euro vs British pound sterling)

So now you know which pairs are favorably liquid, but why is this important? To better understand how liquidity influence prices, let’s scale everything down. Imagine that the liquidity for EURUSD comes from just 100 traders. One day, five people don’t make any orders. Trading volume shows a drop of around 5%. Prices will adjust, but nothing major will happen on the market. Now let’s consider an exotic currency pair like USDSEK. This time, only 10 traders generate the liquidity. One day, five traders don’t make an order. Trading volume drops by around 50%. Prices will adjust rapidly, and dangerous volatility will follow.

It all starts with volume

Let’s look at a real world example to demonstrate how volume changes the behaviour of the currency and price moves. Imagine three vehicles. A car, a bus, and a ship. The car represents those currency pairs that don’t get a lot of trading volume. Cars can be fast, light, and more maneuverable. The car can rapidly swerve or change direction, and even turn around at a moment’s notice. Because of the limited volume, you can expect a wild ride when trading the “smaller” currency pairs. The bus is a heavier vehicle and much less maneuverable, and it carries a much higher volume. It’s not the most popular choice for traders, but the higher volume still offers a slower, less-volatile ride.

The ship is by far the slowest at making course changes. Ships have massive volume compared to other vehicles. These “bigger” currency pairs are traded by many, enjoy endless liquidity, and make for a much smoother ride.The eight listed currency pairs above could be considered “ships”. Major currency pairs have massive volumes, and a change in direction is usually slow. The charts appear smoother with fewer spikes. Simply put, the more liquidity, the more volume, the slower the price change. The exception to this is when something “big” happens. When a nation makes a political or economiceconomic announcement that traders perceive as “bad for business”, investors can make the same conclusion at the same time and abandon the vehicle, destabilizing it as they go..

Example: When the UK announced Brexit in 2016, GBP investors everywhere probably came to the conclusion that a non-EU destination would be economic suicide. GBP investors started jumping ship, and sterling started sinking. Some traders stayed loyal and hopeful, and they are now battling a stormy or volatile transition.

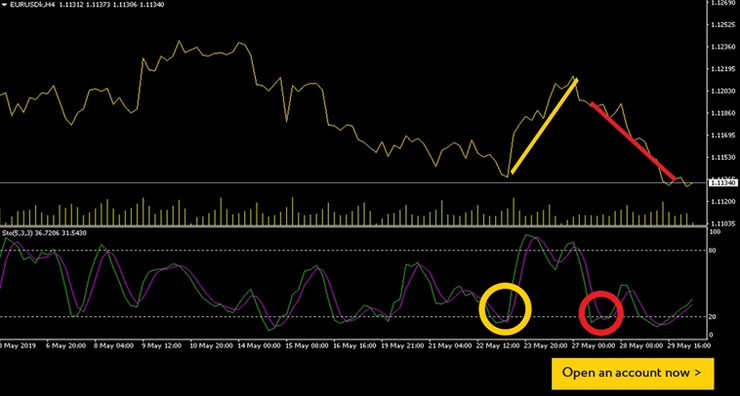

Top tip for high liquidity traders

Trading high liquidity pairs means you can use wider ‘Take Profit’ and ‘Stop Loss’ settings. You might also consider a higher leverage depending on how stable the currency pair is. When checking for price reversals, sharp moves can be misleading. Make sure there’s plenty of volume behind the change. Whichever currency pairs you choose to trade, always take liquidity into consideration before setting leverage and stop orders.