How can you take something beloved by a global community and make it better? With MetaTrader4, MetaQuotes built a trading platform that has become the standard of retail forex traders around the world.

With the global trading community demanding more customization, greater control, and more capabilities, MetaTrader have gone one better and created a next-generation platform called MetaTrader 5.

Available with Exness on Demo accounts, we wanted to give you a sneak peek at the features that make MetaTrader 5 special.

Customizable Approach To Trading: New Features In MT5

There’s nothing more frustrating than not being able to get your chart set up the way you want it, or not being able to place your order exactly the way you want it to be placed.

With MT5 a lot of these frustrations have been eliminated.

Timeframes. MetaTrader 5 offers 21 different timeframes, vs just nine in MetaTrader 4. This means you can get exactly the right chart for your trading strategy, rather than having to make do on MetaTrader 4.

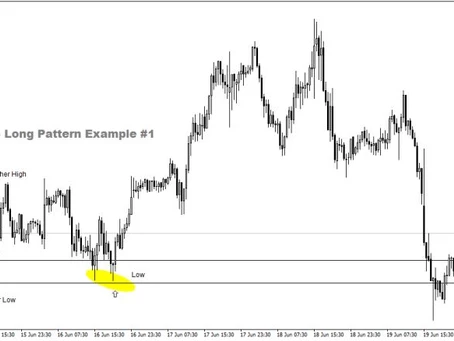

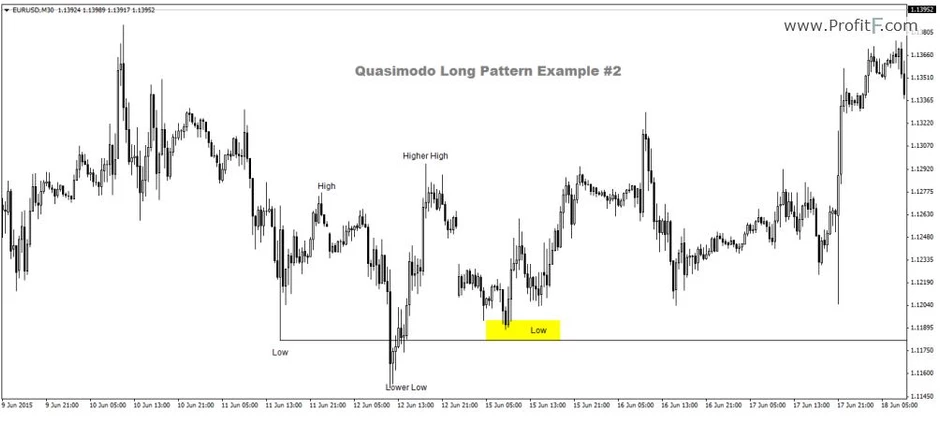

Order types. In MetaTrader 5, you can access two additional pending order types, “buy stop limit” and “sell stop limit”. You can find out more about these in our blog post specifically on the subject of pending order types.

What’s more, with MetaTrader 5 subtle changes in the “navigator” pane mean that you can find what you want, when you want, at a far greater speed.

Analysis

The changes to MetaTrader 5 go beyond simple user experience. Improvements to analytics, testing, and tool building demonstrate how much MetaTrader 5 has been created with the experienced trader in mind.

Fundamental analysis. With MetaTrader 5, traders can benefit from access to economic and industrial news right within their terminal, as well as enjoying a economic calendar highlighting upcoming announcements from around the world. These new tools come bundled with MetaTrader 5 right from launch.Technical analysis. With MetaTrader 5, right out of the box traders get access to 38 indicators and 44 analytical objects, versus 30 indicators and 33 analytical objects in MT4, with a vast number of additional solutions available for free via Code Base or for a price from the new Market feature.

Expert Advisors

EAs were always remarkably valuable in MT4 because they allowed traders to automate some or all of their decision-making to a complex algorithm that could analyse trends and place orders.

In MT5 this functionality is further increased, made possible by the highly advanced MQL5 programming language.

Programming. MT5 is designed from the ground up to empower experienced traders to build powerful EAs themselves. With a programming language similar to C++, it is easy for traders to get their heads around the process and start building. At the same time, less experienced will benefit from access to better quality EAs, which they can test and apply.Market. Even more exciting for experienced traders is the new Market feature, which allows traders who have programmed EAs themselves to make money by selling them to the community, right from the terminal.

Using MetaTrader 5 With Exness

It couldn’t be easier to try out the MetaTrader 5 platform for yourself with Exness. Here’s a simple guide the getting started:

Open an MetaTrader 5 trial or MetaTrader 5 real account from your Personal AreaDownload the MetaTrader 5 desktop or mobile terminal from the Exness downloads pageEnter your account details to log in

What’s more, MT5 accounts can now be used with the WebTerminal. Accessible right from your personal area in the left-hand menu, this means you can start trading on MetaTrader 5 without anything to download!

Try it for yourself.

Open an EXNESS MT5 account today.